Accountants for Freelancers

At Nexus Accounting, we understand that freelancing can be a juggling act. Not only do you have to do your actual job but you also have to take care of your own marketing, sales and accounts. It can be a lot to tackle! That’s where we come in.

We strive to make your life easier by taking care of your accounts and finances so you don’t have to. Our freelancer accounting service offers tailored support for you and your career, allowing you to focus on your craft while we handle the financial complexities that come with freelance work as a limited company.

Find out more about our service and get in touch with our leading accountants for freelancers today!

Accountants for Freelancers

At Nexus Accounting, we understand that freelancing can be a juggling act. Not only do you have to do your actual job but you also have to take care of your own marketing, sales and accounts. It can be a lot to tackle! That’s where we come in.

We strive to make your life easier by taking care of your accounts and finances so you don’t have to. Our freelancer accounting service offers tailored support for you and your career, allowing you to focus on your craft while we handle the financial complexities that come with freelance work as a limited company.

Find out more about our service and get in touch with our leading accountants for freelancers today!

Our Freelancer Accounting Service

If you operate as a limited company, our team of expert freelancer accountants can help you stay on top of your bookkeeping, accounts and help you optimise your business from a financial standpoint.

Our accounting service for freelancers includes:

Why Nexus Is the Right Choice for freelancers

Free Up Time for Core Business Activities

Running a successful business requires concentrating on what you do best. By outsourcing your financial management to expert accountants for freelancers, you can free up valuable time to serve customers, develop products and generate revenue. This also means you can get a strong return on your investment through both time savings and improved financial outcomes.

Financial Expertise and Compliance

Freelancers are tasked with navigating increasingly complex tax regulations and reporting requirements. By working closely with professional freelancer accountants, you can ensure your business remains fully compliant with HMRC rules while identifying legitimate tax efficiencies. Equipped with specialised knowledge, we can help you avoid penalties and charges while maximising available deductions.

Strategic Business Insights

There’s more to accounting than simple bookkeeping. We take all your financial data and transform it into actionable business intelligence. By analysing your financial performance, we can identify trends, inefficiencies and growth opportunities that might otherwise remain hidden. These insights enable informed decision-making about pricing and resource allocation, giving your business a competitive advantage.

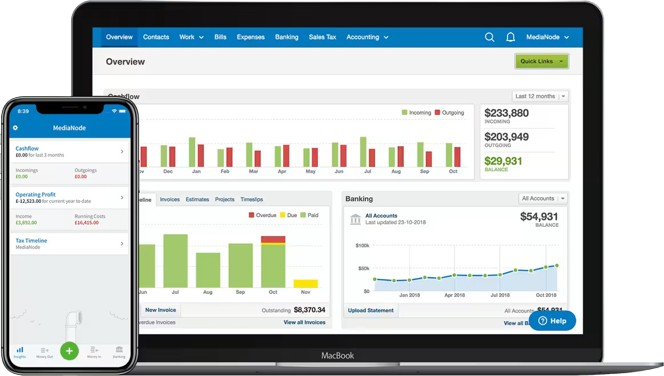

Technology Integration and Efficiency

We believe in taking advantage of modern technology to help grow businesses. That’s why our Limited Company package includes accounting software for freelancers to help you streamline your financial processes. With FreeAgent, we provide you with industry-leading financial software that enables you to have full control and visibility over your accounts.

Excellent customer service

Get a head start on your finances by building a strong financial foundation today. With high-quality online accounting software, all of our new accounting clients can expect only the best service from a dedicated accountant.

Interested in our services? Get in touch with our team today to take your financial management to the next level.

Get in Touch with our Qualified Accountants for

Freelancers Today

If you are looking for an accountant for freelancers in the UK, we can help. At Nexus Accounting, we provide comprehensive accounting services to support your freelance business and enable you to spend more time growing your business. Get in touch with our freelancer accounting experts today to transform your current freelance account management!

Get in Touch with our Qualified Accountants for

Freelancers Today

If you are looking for an accountant for freelancers in the UK, we can help. At Nexus Accounting, we provide comprehensive accounting services to support your freelance business and enable you to spend more time growing your business. Get in touch with our freelancer accounting experts today to transform your current freelance account management!

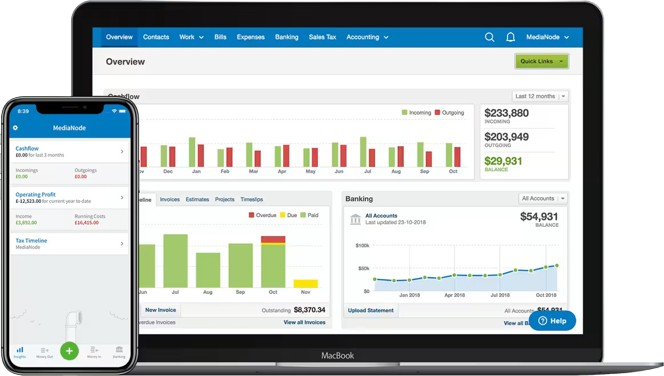

Award Winning Freelancer Accountancy Software with Effortless Admin

FreeAgent is an incredibly simple and effective cloud based accounting solution, which removes the hassle of bookkeeping and provides the information that you need at your fingertips.

Run your entire business from anywhere. Snap an expense, create an invoice, check your cashflow, and stay on top of your tax. Your qualified accountant will help set you up and provide a full walk through of how to make the most of FreeAgent.

Please contact us for a free demonstration.

Award Winning Freelancer Accountancy Software with Effortless Admin

FreeAgent is an incredibly simple and effective cloud based accounting solution, which removes the hassle of bookkeeping and provides the information that you need at your fingertips.

Run your entire business from anywhere. Snap an expense, create an invoice, check your cashflow, and stay on top of your tax. Your qualified accountant will help set you up and provide a full walk through of how to make the most of FreeAgent.

Please contact us for a free demonstration.

Accounting for Freelancers FAQs

Although you are not legally required to have an accountant as a freelancer, most freelancers benefit significantly from a professional accountant with knowledge of the freelancer market. This will help you navigate tax complexities, maximise legitimate deductions and free up valuable time for billable work.

At Nexus Accounting, we offer an all-inclusive Limited Company package that includes services such as bookkeeping, tax planning and accounting software for freelancers. Take a look at our Package page for more information on how our service can be tailored to your needs.

While it’s possible to handle limited company accounts yourself, the process is complex and requires expertise in tax laws, compliance and financial reporting. Using a specialist accountant, like ourselves, ensures accuracy, saves time and helps you avoid costly mistakes or penalties.